Lincoln James Capital is a commercial real estate firm based in Charlotte, NC, but operating throughout the South East USA, that specializes in arranging debt for their multifamily and commercial real estate clients’ needs. They operate daily to earn their reputation as a customer-focused, honest, and dedicated company. Lincoln James Capital simplifies the process of getting the commercial loans you need, so you can move forward with confidence.

They’ve completed over $1 billion in commercial loan transactions.

Lincoln James Capital Specializes in arranging financing for commercial real estate properties and businesses through their expansive network of lenders. With lots of loan program options to choose from, they offer you mortgage alternatives that suit your specific loan situation. And every aspects of the loan process—from the initial loan application to closing are handled by their carefully selected mortgage and in-house closing experts. This helps to speed up the entire loan process and get you the best mortgage terms within a shorter period. Their ultimate goal is to save their clients time and money!

Their core tenants include:

- Commercial Real Estate Financing Unleashed – They provide creative financing solutions to commercial property owners through their extensive lender relationships, in-depth market knowledge, and the determination to exceed expectations.

- Certainty of Execution – In uncertain times, their clients have come to trust that they will deliver on what they’ve promised.

- Philosophy of Excellence – Integrity. Professionalism. Execution. Their philosophy of excellence demands the highest level of honesty, professionalism, and execution.

Visit their website and reach out to their Managing Partner Sokoni Scott to learn more about how they can help you get the financing you need for your commercial real estate project.

While you’re their make sure to check out their case studies section too!

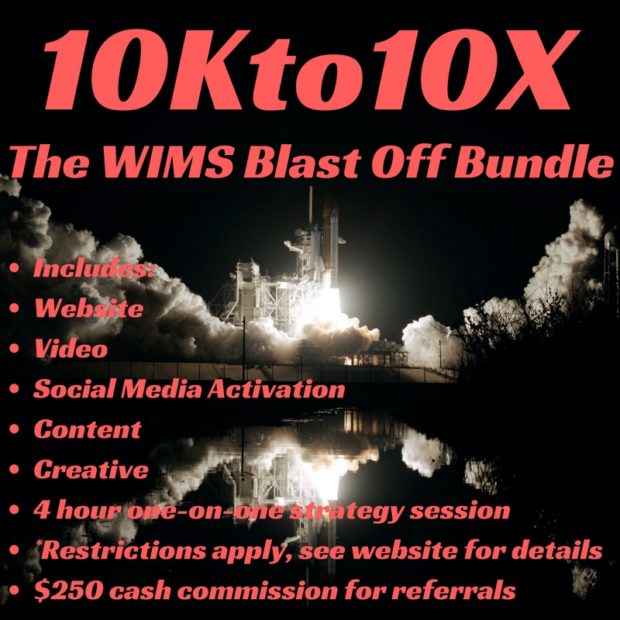

About Mike Simmons & WIMS Consulting

Mike Simmons is the CEO of WIMS Consulting, a consulting firm and full-service marketing and sales agency specializing in marketing strategy, CRM programs, digital marketing, website development, business development, and additional services operating primarily in Charlotte, Miami, Tampa, and Southern California among other cities around the country. The firm’s ventures include equity positions in the following portfolio companies as well: EolianVR, ARRE (Augmented Reality Real Estate), Sunny Money Solar, and LDR BRD.